Posted by: @jeffPart is being done by shifting 75% of the cost of energy levies off bills and into general taxation. However this isnt recorded as a permanent switch in the actual budget documents interestingly. The budget document says 75% of Renewable Obligations, but it will be interesting to see if they actually only mean ROCs or something more including FIT etc.

What is the Renewable Obligations? Is that the roll out of turbines, solar, etc. to make the grid greener?

Posted by: @jeffEverything else being equal it will be roughly 3.3p reduction in the electricity unit rate and 0.3p reduction in the gas (pre VAT). Gas is going down as the ECO scheme is split across gas and electric currently. Also import that this is on the price cap rather than other tariffs, so the change will undoubtedly vary by tariff....

Will this be partially offset with the pre-budget announcement that things like Sizewell-C payments will be added to the tariff?

Get a copy of The Ultimate Guide to Heat Pumps

Subscribe and follow our YouTube channel!

Posted by: @editorWhat is the Renewable Obligations?

This was the original form of subsidy for renewables that ran from 2002-2017, it's much more generous than CfD (because renewables were much more expensive and the massive fall in costs wasn't certain) which has been the replacement since then. RO is index linked, but it's predicted that the early contracts will begin expiry in 2027, so the total RO costs will begin to fall then naturally. RO is the single largest subsidy for renewables and is all on electricity bills today.

Posted by: @editorPosted by: @jeffPart is being done by shifting 75% of the cost of energy levies off bills and into general taxation. However this isnt recorded as a permanent switch in the actual budget documents interestingly. The budget document says 75% of Renewable Obligations, but it will be interesting to see if they actually only mean ROCs or something more including FIT etc.

What is the Renewable Obligations? Is that the roll out of turbines, solar, etc. to make the grid greener?

Posted by: @jeffEverything else being equal it will be roughly 3.3p reduction in the electricity unit rate and 0.3p reduction in the gas (pre VAT). Gas is going down as the ECO scheme is split across gas and electric currently. Also import that this is on the price cap rather than other tariffs, so the change will undoubtedly vary by tariff....

Will this be partially offset with the pre-budget announcement that things like Sizewell-C payments will be added to the tariff?

The Renewal Obligation is the early subsidy that was given to wind, solar, burning rubbish etc. It was for 20 years and gradually finishes between 2027 and 2037. You may have heard of Renewable Obligation Certificates ROCs. That is this line item.

We talked about them recently when we talked about the separate FIT subsidy. There are consultations out to change the indexation from RPI to CPI to reduce costs.

ROCs were replaced with CfD.

Many of these old sites with ROCs are expected to be repowered with new equipment under the CfD scheme. ROCs were more generous overall than CfD. CfD is also on our electricity unit rate but not classed as a levy. So although ROCs will gradually disappear they will be replaced by a lower subsidy over time. No one is willing to build anything without a subsidy of some sort the moment. CfD isn't positioned as a subsidy, it is a guaranteed price for electricity, even electricity that isn't used.

As for the savings in April, yes any savings are offset by the other costs being added to our bills so the net savings may be lower depending on what happens with gas wholesale prices and what changes are made in the Warm Home Plan etc and as you say nuclear costs.

@Jeff, how much other "fat" is loaded into the tariff... I find the subject fascinating.

Get a copy of The Ultimate Guide to Heat Pumps

Subscribe and follow our YouTube channel!

@editor - it depends on what you count as 'fat' !

What about the £10's of millions taken by Ofgem and NESO to create and enforce 'Governance' for the energy sector?

The DNOs, NGET etc are heavily invested in engineers who actually do the required work.

But NESO, and even more-so Ofgem, are primarily people who create strategies and programs.

They develop consultations, collate the responses, and issue reports.

That's a very expensive management operation.

If it were to occur in industry, then the imbalance of management and workers would cause the business to collapse.

Unlike DESNZ, Ofgem & NESO are very difficult to hold to account.

They are heavily involved in self-preservation, but aren't liable to the same oversight as the civil service.

Save energy... recycle electrons!

Posted by: @transparent@editor - it depends on what you count as 'fat' !

What about the £10's of millions taken by Ofgem and NESO to create and enforce 'Governance' for the energy sector?

The DNOs, NGET etc are heavily invested in engineers who actually do the required work.

But NESO, and even more-so Ofgem, are primarily people who create strategies and programs.

They develop consultations, collate the responses, and issue reports.That's a very expensive management operation.

If it were to occur in industry, then the imbalance of management and workers would cause the business to collapse.Unlike DESNZ, Ofgem & NESO are very difficult to hold to account.

They are heavily involved in self-preservation, but aren't liable to the same oversight as the civil service.

£148m opex and capex for ofgem in 2025/2026 loaded onto companies ofgem licence, which is then up to them how they pass on the costs.

We can probably find costs for the others.

The sceptic in me wonders whether people who use split tariffs - eg Cozy Octopus, Intelligent Octopus Go and others - will see little if any reduction in their night/off peak kWh rate as they are well below the price cap. The typical household savings quoted so far by the government and industry bodies seem to take no account of this.

Mitsubishi Ecodan 11.2kW R32 ASHP; Ecodan DHW cylinder; UFH+rads

20x430W Jinko TOPCON Tiger Neo solar; Luxpower 6+4kW hybrid inverter; 20kWh Hanchu ESS LFP battery storage

PHEV; Zappi charger

1997 stone detached house with updated insulation. 140sqm, maintained at 20-22degC 24/7

I think we do need to be investigating these costs @jeff

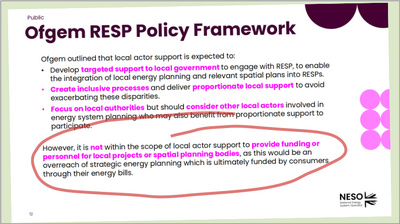

I attended a NESO webinar this morning on Local Actor Support.

They define a Local Actor as someone who is involved with energy planning, which would typically be a local-government officer.

The feedback submissions which appeared on our screens suggested that a large proportion of the 128 attendees were indeed in such a role.

Here's one of the slides from this morning's presentation

In other words, there's no money available for training, workshops and seminars of Local Actors because it would be a misuse of Bill-payers' money...

but there's plenty of money for several hundred NESO staff who are developing the strategies and governance which dictates how future energy is be planned and implemented.

One participant filed an online/written question asking "What's the legal Status of the Regional Energy Strategic Plan document which will cover my area?"

There was no clarity of response from the NESO staff leading the webinar.

But I can see what the questioner was after...

He/she needs to know if, as a professional planner, they will have to comply with a set of regulations (the RESP) which has been compiled by NESO according to their own set of rules.

If the Regional Plan to be published in 2027 dictates a requirement for

- an additional 2GVA of capacity in the 132kV level of the grid

- greater capacity for onshore wind generation in winter, to address the current dominance of solar

- expansion of the Primary substation compounds to facilitate BESS owned and operated by third-parties

does this mean that there is no longer any opportunity for residents to submit objections to planning applications for pylons, commercial wind-farms and 3rd-party infiltration into our electricity supply network?

Whither democracy and the Councils who presently implement it?

Save energy... recycle electrons!

@skd Yes, I have been having the same thoughts and …. am I being sceptical when I think that all energy price reductions tend to apply AFTER the heavy usage period - never during or before it starts? Sceptically, Toodles.

Toodles, heats his home with cold draughts and cooks food with magnets.

Posted by: @skdThe sceptic in me wonders whether people who use split tariffs - eg Cozy Octopus, Intelligent Octopus Go and others - will see little if any reduction in their night/off peak kWh rate as they are well below the price cap. The typical household savings quoted so far by the government and industry bodies seem to take no account of this.

Martin Lewis is asking questions around other tariffs including fixed rate tariff so we may get a response.

Ultimately it is a commercial decision. Octopus have been open in the past that some of their tariff are loss leaders. It is a highly competitive environment.

The price cap is what suppliers can charge on the default tariff. Their actual costs may be higher or lower, for example good power purchase agreements, good hedging, better management of defaults, lower opex etc etc. Hence why suppliers go bust..

Would Octopus make a stand and reduce all their tariff by the same amount? It would show leadership.

Be interesting to see what happens.

The manifesto commitment was £300 off bills, but this is interpreted as dual fuel price cap. It was a rubbish commitment given all the costs being added so they have fudged it by scrapping ECO and moving some costs to general taxation to get a nominal £150 off. That feels like smoke and mirrors to me. The public will be totally confused if we end parliament without bills £300 lower in real terms.

@jeff I'm on Octopus Tracker, recent price range has been 12.44 to 26.45p/kWh. I suppose the average rate has been around 21.5p.

If price cap gets 4p cheaper in todays prices, it's not going to be worth customers taking the risk on Tracker. So I assume Tracker and other tariffs may be recalculated, and market competition may play a role in the energy providers decisions.

Of course Octopus might decide they don't care, but as it's a lower risk product for them (no hedging costs) I assume they will reflect the reductions into Tracker from at least their newer contracts.

Fortunately for me my Tracker expires within a few days before the 1st April so I will be able to choose whether to stick or twist.

Posted by: @jeffThe public will be totally confused if we end parliament without bills £300 lower in real terms.

Are we ending Parliament @jeff ?

I must've missed that Topic.

I thought it was just the MCS we were seeking to no longer be in place.

Save energy... recycle electrons!

- 27 Forums

- 2,523 Topics

- 58.7 K Posts

- 455 Online

- 6,802 Members

Join Us!

Worth Watching

Latest Posts

-

RE: Underfloor Heating Installation Issues with Heat Pump

This looks like a practical solution 👍

By bobflux , 5 hours ago

-

It's a detached house with a fairly large split-level e...

By petch , 5 hours ago

-

Your installer may well be right. If the WC curve isnt...

By JamesPa , 6 hours ago

-

RE: Our 10 year old Grant heat pump failed

Same as many boilers, ovens washing machines and other ...

By JamesPa , 8 hours ago

-

RE: Home energy storage & battery register

3 X Pylontech US2000 Plus @ 2.4 Kw each = 7.2 Kw SoFa...

By vzm56n , 9 hours ago

-

RE: Daikin Altherma 3 LT compressor longevity question

So on this question of compressor longevity, I have a D...

By Optimistic Optimiser , 10 hours ago

-

Horizontal Hot Water Cylinders for ASHP with Energy Efficiency Rating 'A'

I looking to Have an ASHP installed in the near future....

By vzm56n , 10 hours ago

-

RE: Noisy Grant Aerona 3 13kW ASHP question

Here's a LibreOffice spreadsheet. I put the formula f...

By bobflux , 15 hours ago

-

RE: Electricity price predictions

I assumed you were joking here. Hence my joke about ...

By Batpred , 16 hours ago

-

RE: Struggling to get CoP above 3 with 6 kw Ecodan ASHP

Photos of cylinder cupboard and UFH manifold would be u...

By Travellingwave , 20 hours ago

-

RE: My misgivings about installing ASHP and solar panels via the ECO4 scheme...

It has been some time since I posted comments about Eco...

By Dwynwen , 1 day ago

-

RE: Forum updates, announcements & issues

Something big is coming to Renewable Heating Hub! Ove...

By Mars , 1 day ago

-

RE: A Single Voice for Heat Pumps, But Will It Finally Raise Industry Standards?

From what I’ve read, the Heat Pump Association UK is me...

By Jonatan , 2 days ago

-

RE: Tell us about your Solar (PV) setup

Pylontech US5000 stores about 4.3 kWh accounting for in...

By bobflux , 2 days ago

-

RE: Octopus Cosy 12 Heat Pump Regret: Incredibly Loud, Poor Heating & Constant Hum - Help!

Hi all, Just an update on where we are with the "Consta...

By DEdwards , 2 days ago

-

RE: How to control DHW with Honeywell EvoHome on Trianco ActiveAir 5 kW ASHP

Well I've had an interesting few days and would like to...

By giganto , 2 days ago

-

RE: Peak Energy Products V therm 16kW unit heat pump not reaching flow temperature

Yes, here's mine. From the service manual parts numbers...

By bobflux , 2 days ago

-

Had to learn the hard way 🤣 now I'm sharing T...

By bobflux , 2 days ago

-

RE: Issue with a Grant Air Source Heat Pump & Tado Smart Thermostat

Im assuming from your original post that hysterisis ref...

By JamesPa , 2 days ago

-

RE: Heat Pump vs New Gas Boiler for Inherited House - Worth the Extra Cost?

Hi @fretless6 Mike, I have experience with Taggas (Re...

By Old_Scientist , 3 days ago

-

RE: Testing new controls/monitoring for Midea Clone ASHP

Now seems a good time to summarise the costs and effici...

By benson , 3 days ago

-

RE: Connecting Growatt SPH5000 over wired ethernet rather than wireless

The simplest wired option is usually the Growatt Ethern...

By Jonatan , 3 days ago