Posted by: @marzipan71I'm out in Italy and the current wholesale price of electricity here is ca. 11 or 12c per kWh. This is what I pay our supplier each month (monthly average wholesale price) plus network costs, taxes etc, and currently translates into a bill price of 26c to 29c or so per kWh.

Hello,

Most folks here are, as you probably know, talking about the UK electricity market, here there are two items domestic consumers pay for (similar things happen for supplying electricity to the grid, i.e. exporting):

- standing charge, a fixed charge per day.

- a price for electricity consumed in pence per kwh. This may, in the extreme case, change every half hour.

Both of these are extremely variable depending on the tariff from the utility. Some tariffs have constraints in terms of who can qualify (e.g. people that have an EV or a heat pump are able to access special tariffs in their home), but generally consumers are free to choose their supplier and tariff and change when they see fit.

It would help to see how the items you show impact the calculation of price of 26 c/kWh.

8kW Solis S6-EH1P8K-L-PLUS hybrid inverter; G99: 8kw export; 16kWh Seplos Fogstar battery; Ohme Home Pro EV charger; 100Amp head, HA lab on mini PC

Posted by: @jeffInteresting to see the net effect. Unit rates of electricity increasing, Unit rates of gas falling.

Yes, I read a short piece in the Guardian. This really surprised me:

I am not sure what this means for these households and if they are having levies or interest added to this debt. But any gov would be sensitive to these difficult situations. Not to say the reason for the increase would have to do with energy prices as people's decision of where to build debt. Building debt is a sign of imbalance of income vs expenses and causes for it may vary widely.

The article also mentions that the cost of the government’s energy policies has been pushing the cap higher. Hopefully they will decide to move these policy costs to general taxation where they really belong.

8kW Solis S6-EH1P8K-L-PLUS hybrid inverter; G99: 8kw export; 16kWh Seplos Fogstar battery; Ohme Home Pro EV charger; 100Amp head, HA lab on mini PC

@marzipan71 you may find that the supplier is buying direct from an energy generator, a type of contract called a Power Purchase Agreement, which is much better for both the generator and the buyer than going through the open market. This is sometimes how wind farms and solar plants get their seed money to make a project viable, maybe 60% is sold via PPA the rest sold on the open market.

My energy tariff here in the UK is a different daily price each day, based on the actual day ahead wholesale price, most days cheaper, sometimes more expensive than standard rates. The reason it's mostly cheaper is the energy supplier isn't taking the risk, I am.

My point is the energy markets are complex, and there are many ways to bundle deals that give different results.

Hi there - thanks for reply. Yes, of course the focus here is mostly UK electricity prices and as an ex-pat I recall how my bills were constructed when I was living in the UK. Its essentially similar here in Italy - there's a consumption price (which in my post is the current 11c or 12c, the wholesale electricity price), and various other fixed or variable elements (including charges for network losses, a marketing fee, transport costs, system owner charges, and taxes). I built a simple spreadsheet model that allowed me to predict my monthly bill based upon consumption, and having monitored this for a couple of years the monthly bill has been around (beware spurious accuracy) 238% of the consumption price. I can look at my consumption through the month, extrapolate that out to month end, and convert it to a likely bill charge, usually to within a few tens of euros. We are free to change suppliers whenever we wish and suppliers have a range of tariffs; I'm paid the wholesale rate for whatever I send back to the grid from my solar. I didn't want to get too technical in my post or spark a discussion of the relative merits or otherwise of supplier pricing strategies.

Broadly speaking, the price of electricity in both the UK and continental Europe is, in my understanding, tied to gas prices (the marginal pricing system), and I do understand the energy cap in the UK. My question was - in the spirit of the thread - do people think that wholesale electricity prices are likely to rise, stay the same, or fall in the next 12 months? Given that ENEL are offering a fixed rate deal here that is priced around one third below the current wholesale rate, my take is that could be a bellweather for where the markets are heading - that is, they would have to fall even further for ENEL's deal to be profitable - but I find that a little hard to believe. The 12 month fixed rate tariff offers of other suppliers are priced currently around 10 or 11c. If its a redundant question due to differences in the structure of the UK and European wholesale markets, I apologise - I was just looking to understand if anyone had strong opinions one way or another on broad market trends in the year ahead. Thanks for reading!

Posted by: @scalextrix@marzipan71 you may find that the supplier is buying direct from an energy generator, a type of contract called a Power Purchase Agreement, which is much better for both the generator and the buyer than going through the open market. This is sometimes how wind farms and solar plants get their seed money to make a project viable, maybe 60% is sold via PPA the rest sold on the open market.

My energy tariff here in the UK is a different daily price each day, based on the actual day ahead wholesale price, most days cheaper, sometimes more expensive than standard rates. The reason it's mostly cheaper is the energy supplier isn't taking the risk, I am.

My point is the energy markets are complex, and there are many ways to bundle deals that give different results.

Thanks - that's interesting. I've been looking at these 12 month fixed rate deals over the past few years and they always seem to offer a lower than current wholesale market rate, only to see that rate fall below that offering over time - that is, the supplier has a sense of where the market is heading and prices slightly above of course. The futures rates are publicly available here on the same site that publishes the daily wholesale rates. The daily rates averaged over the month to produce a rate which is then applied to my monthly consumption - this has mostly been around 10c this year (there are different rates for 'mono' rate which applies to all time periods and for distinct time bands - F1, F2, F3 - which are roughy like day and night rates in the UK, but the differences are not really significant, to me at least).

Agree the markets are complex and so my question might not be a great one, but as I mention above I was just looking to see if anyone had any strong feelings one way or another about the next 12 months, as the ENEL offer seemed low to me.

Posted by: @toodlesNext summer, I may start to receive some returns on my Derril Water Solar Park investment.

I expect to be addressing a meeting of residents living in the vicinity of Derril Water next spring.

If you want some returns, I'll collect a jar of tadpoles for you.

That rural area already has 13 solar parks connected to the Bulk Supply Point, plus three onshore wind farms.

They are now facing a planning application for another solar park, which will be referred to the Planning Inspectorate.

The 'developers' are an overseas-based Investment Management group, who propose covering 2700-acres in solar panels.

Of course, they'll be able to claim a precedent has been set, and refer to consent already granted to the owners of Derril Water and the other sites.

What message do you think the local population would like to send to those who 'invested' in the 16 existing renewable energy locations

now scattered across picturesque rural Devon?

Save energy... recycle electrons!

So bills going down following budget

1. The reduction will start at the 1 April price cap.

2. Everything else being equal it will be roughly 3.3p reduction in the electricity unit rate and 0.3p reduction in the gas (pre VAT). Gas is going down as the ECO scheme is split across gas and electric currently. Also import that this is on the price cap rather than other tariffs, so the change will undoubtedly vary by tariff....

3. For someone on typical bills this will equate to roughly £150/yr reduction (clearly use more its bigger, use less its smaller)

4. Part is being done by shifting 75% of the cost of energy levies off bills and into general taxation. However this isnt recorded as a permanent switch in the actual budget documents interestingly. The budget document says 75% of Renewable Obligations, but it will be interesting to see if they actually only mean ROCs or something more including FIT etc.

5. Part is by scrapping Eco Scheme and putting more funds into Warm Home scheme. Basically the ECO scheme has been a financial disaster in actually cutting bills in practice according to the government, 97% of cases. The government would have done better to just give people money off their bill if they were struggling in essence.

If wholesale gas prices stay low and go lower if the Ukraine war ends we could see further downward pressure.

Obviously the EV per mile charge will hike overall costs for some...

Be worth looking out for responses from ofgem, nesta, cornwall insight to get more clarity on exactly what is shifting to general taxation and any shift between electricity and gas....

Cornwall Insight view of Bill reduction

Gives a bit more info on the amounts but not the gas/electricity split. The RO cut is only for 3 years.

As a comparison the government says

-Green levies, put on general taxation, will save households £88 a year

- £59 saving will be made by scrapping ECO.

So split is different... Anyway it is in that ball part...

The RO is currently all on electricity, the ECO split between gas and electricity.

The RO funds the early wind farms etc prior to the introduction of the CfD. Many of these early wind farms are expected to repower with new turbines once their RO expires, probably under the CfD scheme. So in the future we will see costs on our bills again I am sure...

From Nesta;

https://www.nesta.org.uk/blog/what-does-the-budget-mean-for-energy-bills/

Agrees generally with other articles, however notes an option to move the 25% of RO to gas. Remains to be seen if that is done.

Also worth noting the RO should start to reduce from 2027 anyway as contracts continue to reach expiry.

I do like the Nesta articles generally, including the price cap breakdown every quarterly change.

Shifting ROCs and even FIT to gas would help short term, although it would be slightly inflationary and push up the overall cost of dual fuel users as there are less gas users than electricity users. The ROCs would be spread across less customers, circa 85% of households depending on what figure is used.

This would reduce the saving that the government has now gone public on and push up the CPI rate I suspect.

So it depends on the focus, reduce inflation short term for dual fuel customers or reduce the gap between electricity and gas. Short term cost of living support for the mass market vs making heat pumps more viable.

We also have a whole load of costs coming. Capacity Market costs are estimated to go from circa £1b to £4b by 2030... increasing CfD costs, increasing network costs...repowering the ROC supported sites onto CfD from 2027... Nuclear costs... Etc.

Cornwall Insight have warned there is no respite for years to come.

I found the statement in the budget "red book" that Nesta would be referring to:

"2.6 The government is committed to doing more to reduce electricity costs for all

households and improve the price of electricity relative to gas. The government will consider how to further target the savings announced in the Budget at electricity bills, including the savings derived from ending the Energy Company Obligation

scheme. The government will set out how it intends to deliver this through the Warm Homes Plan.".

So watch out for the WHP.

Sauce

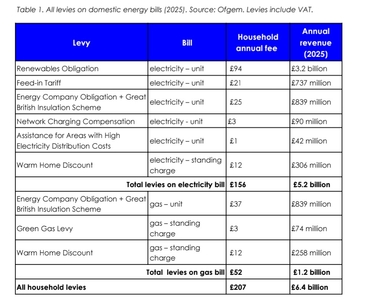

Useful table showing where all the levies are.

This doesn't include the extra costs for CfD, network upgrades, capacity market, balancing costs, bad debt costs, nuclear costs. Those are the big costs coming.

The challenge is even if they move the remaining 25% ROC cost to gas for three years, this is dwarfed by the other costs we already know are coming.

It is all smoke and mirrors unless they do something really radical.

Interesting to see the current value of the Network Charging Compensation Scheme on domestic bills in the above table vs the scheme cost from next April. Not an area I know much about, including how to compare the figures.

Currently viewing this topic 20 guests.

Recently viewed by users: ASHP-BOBBA 58 minutes ago.

- 27 Forums

- 2,523 Topics

- 58.7 K Posts

- 476 Online

- 6,802 Members

Join Us!

Worth Watching

Latest Posts

-

RE: Underfloor Heating Installation Issues with Heat Pump

This looks like a practical solution 👍

By bobflux , 2 hours ago

-

It's a detached house with a fairly large split-level e...

By petch , 2 hours ago

-

Your installer may well be right. If the WC curve isnt...

By JamesPa , 3 hours ago

-

RE: Our 10 year old Grant heat pump failed

Same as many boilers, ovens washing machines and other ...

By JamesPa , 6 hours ago

-

RE: Home energy storage & battery register

3 X Pylontech US2000 Plus @ 2.4 Kw each = 7.2 Kw SoFa...

By vzm56n , 7 hours ago

-

RE: Daikin Altherma 3 LT compressor longevity question

So on this question of compressor longevity, I have a D...

By Optimistic Optimiser , 7 hours ago

-

Horizontal Hot Water Cylinders for ASHP with Energy Efficiency Rating 'A'

I looking to Have an ASHP installed in the near future....

By vzm56n , 7 hours ago

-

RE: Noisy Grant Aerona 3 13kW ASHP question

Here's a LibreOffice spreadsheet. I put the formula f...

By bobflux , 12 hours ago

-

RE: Electricity price predictions

I assumed you were joking here. Hence my joke about ...

By Batpred , 13 hours ago

-

RE: Struggling to get CoP above 3 with 6 kw Ecodan ASHP

Photos of cylinder cupboard and UFH manifold would be u...

By Travellingwave , 17 hours ago

-

RE: My misgivings about installing ASHP and solar panels via the ECO4 scheme...

It has been some time since I posted comments about Eco...

By Dwynwen , 1 day ago

-

RE: Forum updates, announcements & issues

Something big is coming to Renewable Heating Hub! Ove...

By Mars , 1 day ago

-

RE: A Single Voice for Heat Pumps, But Will It Finally Raise Industry Standards?

From what I’ve read, the Heat Pump Association UK is me...

By Jonatan , 1 day ago

-

RE: Tell us about your Solar (PV) setup

Pylontech US5000 stores about 4.3 kWh accounting for in...

By bobflux , 2 days ago

-

RE: Octopus Cosy 12 Heat Pump Regret: Incredibly Loud, Poor Heating & Constant Hum - Help!

Hi all, Just an update on where we are with the "Consta...

By DEdwards , 2 days ago

-

RE: How to control DHW with Honeywell EvoHome on Trianco ActiveAir 5 kW ASHP

Well I've had an interesting few days and would like to...

By giganto , 2 days ago

-

RE: Peak Energy Products V therm 16kW unit heat pump not reaching flow temperature

Yes, here's mine. From the service manual parts numbers...

By bobflux , 2 days ago

-

Had to learn the hard way 🤣 now I'm sharing T...

By bobflux , 2 days ago

-

RE: Issue with a Grant Air Source Heat Pump & Tado Smart Thermostat

Im assuming from your original post that hysterisis ref...

By JamesPa , 2 days ago

-

RE: Heat Pump vs New Gas Boiler for Inherited House - Worth the Extra Cost?

Hi @fretless6 Mike, I have experience with Taggas (Re...

By Old_Scientist , 2 days ago

-

RE: Testing new controls/monitoring for Midea Clone ASHP

Now seems a good time to summarise the costs and effici...

By benson , 3 days ago

-

RE: Connecting Growatt SPH5000 over wired ethernet rather than wireless

The simplest wired option is usually the Growatt Ethern...

By Jonatan , 3 days ago