What I find difficult to reconcile, and also find an explanation, is the large difference in electricity prices from different sources.

Cornwall Insight are predicting prices much higher than the present price guarantee, the present TOU tariff being offered by Octupus today ranges from 16.8p to 33.03p, but how much it may be reduced by the price guarantee is difficult to assess.

On the grid.iamkate website, the wholesale electricity prices range form 7.8p to 24.7p over the past 24 hours.

If the wholesale price in the balancing mechanism, which I would expect to be the higher end of the range since longer term contracts would hopefully be more financially beneficial, then why are the tariffs offered to consumers so high in comparison.

In the present situation I feel there is a need for greater transparency as to who is paying what for energy in bulk, and identify which companies are making vast profits from their customers.

The difference between electricity wholesale prices and what the customers are charged is accounted for by

Network costs; charges to use the Transmission and Distribution grid

Environmental and Social obligations; contributions towards home insulation schemes, FIT payments etc

ROC purchases; buying in enough Renewable Obligation Certificates to match the amount of green-energy promised to their customers

Metering; installation of (smart) meters, and payments to the Data Communications Company for data access

Direct costs; fees to brokers (online comparison sites), third party services (ECOES, Morrison Data Services)

Operating costs; Customer Services, Billing, debt servicing, office space rental - generally around 16% of the final bill

Legal obligations; fines & penalties levied against the company

Save energy... recycle electrons!

Posted by: @transparentThe difference between electricity wholesale prices and what the customers are charged is accounted for by

Network costs; charges to use the Transmission and Distribution grid

Environmental and Social obligations; contributions towards home insulation schemes, FIT payments etc

ROC purchases; buying in enough Renewable Obligation Certificates to match the amount of green-energy promised to their customers

Metering; installation of (smart) meters, and payments to the Data Communications Company for data access

Direct costs; fees to brokers (online comparison sites), third party services (ECOES, Morrison Data Services)

Operating costs; Customer Services, Billing, debt servicing, office space rental - generally around 16% of the final bill

Legal obligations; fines & penalties levied against the company

I suspect that there is still a, unaccounted for, large difference.

I tend to think the opposite about the (surviving) UK energy suppliers. I suspect they're finding it difficult to meet their obligations within the revenue coming in. Moreover they are dealing with an increasingly large proportion of their customer base who have to be evaluated for non-payment.

A few days ago Ofgem published a 'name & shame' list of Suppliers who weren't fulfilling the terms of their licence in respect of customers on the PSR (Priority Services Register). One category which I noted, referred to PSR households having not been proactively telephoned by the Supplier in the preceding 12 months.

If I was a Director of an Energy Supplier in the middle of the Energy Crisis, I'd be quietly relieved if that's all that my company had been picked up for!

Ofgem receive monthly reports from the domestic energy Suppliers, which they collate into a public document twice yearly. You can obtain the latest Supplier Report here.

Save energy... recycle electrons!

I appreciate that the actual energy suppliers are not making vast profits if any. I know that Octopus claim to not be making a profit at all.

I fully understand that the wholesale price of gas shot through the roof, but I think someone posted on the forum that the price had dropped quite considerably recently, in fact today there was a report that it had fallen by 6%.

I don't think that your list of additional costs would fill the 'black hole', unless some traders are manipulating the market in their favour. Have you ever watched the film 'Market Call'? If not, I suggest that you should.

I'm afraid that big business cannot be trusted, and during this energy crises should warrant closer scrutiny.

As consumers and probably also taxpayers, we are footing the bill one way or the other, I therefore feel that it is not unreasonable to ask questions about where all this money is going.

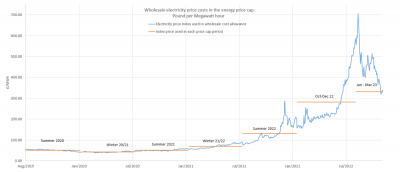

The price cap is always based on historical data so it doesn't matter what the wholesale price is now or even the last couple of weeks as there is a cut for the period used to make the calculations.

The costs on iamkate bear no relation to the vast amount of energy which is hedged. In fact that is the only way to operate in the current market as we saw from the collapsed suppliers. The risk is too great.

So we are already well in the period for calculating the next cap which will be announced on the 27 February 2023 and come into operation on 1st April 2023.

There can be a huge difference between the cap and the more recent prices.

Where is the money going?

- Fossil fuel companies have made a killing

- Non fossil fuel generators not on the more recent CfD contracts have made a killing

- LNG traders shipping gas have made a killing. Gas at times is dramatically cheaper in the US for example.

Posted by: @derek-mI fully understand that the wholesale price of gas shot through the roof, but I think someone posted on the forum that the price had dropped quite considerably recently, in fact today there was a report that it had fallen by 6%.

Ah... yes, you're quite right.

However there are several reasons why the fall in the price of gas doesn't transfer directly across to the electricity wholesale market.

1: Although an Electricity Generation Site may be using gas, the price they get paid for that electricity is still subject to the half-hourly settlement rules. If the last trade of the auction results in setting the price of electricity high, then the Generation Site still gets paid that amount. They may have been prepared to sell for less, but it's the EpexSpot trading platform which has dictated what they must be paid.

2: Larger companies, such as Centrica, buy most of their electricity far in advance. The actual cost of the gas-generation today may be very much less, but British Gas' electricity customers will still get charged at the higher rate which was negotiated months ago.

3: To stabilise the market being tracked by their Buyers, most Suppliers hedge their purchases. The actual price may have dropped, but the cost of the hedged-arrangement must still be paid, even if it wasn't called upon this time.

... and several more reasons of course.

I still feel that a large chunk of the problem has come about because we've had years of the Buyers getting skilled at meeting the requirements of a customer-base which is dominated by 1-year fixed-price contracts.

That kept one part of their balancing operation extremely stable/predictable, whilst they merely had to buy what was required per half-hour.

Now both sides of the pan balance are fluctuating, because the majority of us customers didn't take out a new fixed-price contract when the previous one expired. Handling that requires expertise which many Buyers didn't have.

If Ofgem had required all Energy Suppliers to have issued at least one ToU tariff by the end of 2021, then I suspect we'd now be in a much better situation.

Save energy... recycle electrons!

I fully understand about hedging and how the half hourly electricity trading market works with every generator being paid the highest price. I worked in the Power Generation Industry when it was privatised, and this was how the original trading system worked. After a while it was discovered that the pricing system was being manipulated by some of the players, so it was changed so that the various generators would get paid the price that they bid in, not necessarily the highest price.

What I would like to know is which idiot changed the system back from a much fairer system, to the one that had previously been proven to be flawed and open to manipulation, and for what reason?

TOU tariffs may seem like an excellent idea, but I suspect that the vast majority of consumers would not be able to afford the necessary additional equipment required to take full advantage of the benefits that such a system would offer.

A possible better solution would be larger electricity storage systems, ideally controlled and operated by the DNO's, or at least companies such as Octopus, who appear to have customer's best interest at the heart of their operation.

Don't get me wrong, I am not against TOU and will hopefully be joining the small merry band of consumers with battery storage some time next year. A further major problem is that the vast majority of consumer's, I suspect, prefer predictability when it comes to their energy bills, and may be reluctant to sign up to a system like Octopus Agile, who's prices can vary quite considerably. But please don't let me put anyone off doing so.

Just had an update in from Bulb re an increase in January and another in April! 😵💫

The Energy Price Guarantee is an average across the country based on a dual fuel direct debit customer using 12000kWh gas and 2900kWh electricity.

When Ofgem updated their regional figures for 1st Jan, some of the region figures changed but the average across the country under the EPG remains the same.

So many people are receiving slightly updated tariff for 1st Jan

The bigger increase is coming 1st April when the EPG goes up 20%...

I expect that will be a big shock for many as the universal Energy Bill Support Scheme stops at the same time... A large cohort of relatively vulnerable people will get a shock just how big their summer bills are compared to previous years.

Rising energy bills, council tax, rent and mortgages is a real worry for the year ahead IMHO.

Currently viewing this topic 5 users ( Papahuhu, SKD, Majordennisbloodnok, Toodles, Batpred ) and 9 guests.

Recently viewed by users: Sheriff Fatman 30 minutes ago, Transparent 37 seconds ago.

- 27 Forums

- 2,495 Topics

- 57.8 K Posts

- 312 Online

- 6,220 Members

Join Us!

Worth Watching

Latest Posts

-

RE: Setback savings - fact or fiction?

I fully understand your reasoning, same steady inputs s...

By cathodeRay , 9 minutes ago

-

RE: Electricity price predictions

@skd I think your guess might well be right - unfortuna...

By Toodles , 19 minutes ago

-

RE: Humidity, or lack thereof... is my heat pump making rooms drier?

@majordennisbloodnok I’m glad I posted this. There see...

By AndrewJ , 30 minutes ago

-

RE: What determines the SOC of a battery?

@batpred I didn't write the Seplos BMS software, I a...

By Bash , 2 hours ago

-

RE: Testing new controls/monitoring for Midea Clone ASHP

@tasos and @cathoderay thanks. I have some history grap...

By benson , 2 hours ago

-

I am having my existing heat pump changed to a Vaillant...

By trebor12345 , 3 hours ago

-

Our Experience installing a heat pump into a Grade 2 Listed stone house

First want to thank everybody who has contributed to th...

By Travellingwave , 3 hours ago

-

RE: Solis inverters S6-EH1P: pros and cons and battery options

Just to wrap this up here for future readers: The S...

By Batpred , 6 hours ago

-

RE: Struggling to get CoP above 3 with 6 kw Ecodan ASHP

Welcome to the forums.I assume that you're getting the ...

By Sheriff Fatman , 6 hours ago

-

RE: Say hello and introduce yourself

@editor @kev1964-irl This discussion might be best had ...

By GC61 , 8 hours ago

-

@painter26 — as @jamespa says, it's for filling and re-...

By cathodeRay , 11 hours ago

-

RE: Oversized 10.5kW Grant Aerona Heat Pump on Microbore Pipes and Undersized Rads

@uknick TBH if I were taking the floor up ...

By JamesPa , 22 hours ago

-

RE: Getting ready for export with a BESS

I would have not got it if it was that tight

By Batpred , 24 hours ago

-

RE: Need help maximising COP of 3.5kW Valiant Aerotherm heat pump

@judith thanks Judith. Confirmation appreciated. The ...

By DavidB , 1 day ago

-

RE: Recommended home battery inverters + regulatory matters - help requested

That makes sense. I thought better to comment in this t...

By Batpred , 1 day ago

-

Bosch CS5800i 7kW replacing Greenstar Junior 28i

My heat pump journey began a couple of years ago when I...

By Slartibartfast , 1 day ago

-

RE: How to control DHW with Honeywell EvoHome on Trianco ActiveAir 5 kW ASHP

The last photo is defrost for sure (or cooling, but pre...

By JamesPa , 1 day ago

-

RE: Plug and play solar. Thoughts?

Essentially, this just needed legislation. In Germany t...

By Batpred , 1 day ago

-

RE: A Smarter Smart Controller from Homely?

@toodles Intentional opening of any warranty “can of wo...

By Papahuhu , 1 day ago

-

RE: Safety update; RCBOs supplying inverters or storage batteries

Thanks @transparent Thankyou for your advic...

By Bash , 1 day ago

-

RE: Air source heat pump roll call – what heat pump brand and model do you have?

Forum Handle: Odd_LionManufacturer: SamsungModel: Samsu...

By Odd_Lion , 1 day ago

-

RE: Configuring third party dongle for Ecodan local control

Well, it was mentioned before in the early pos...

By F1p , 2 days ago

-

RE: DIY solar upgrade - Considering adding more panels

I know this is a bit old, but it made me wonder what co...

By Batpred , 2 days ago